Sarah's world shattered when her brother, Mark, died unexpectedly. Amidst the profound grief, a new nightmare unfolded: Mark, a passionate early crypto adopter, had left behind a significant digital fortune – but no clear instructions. Wallets, exchanges, seed phrases – all locked away in his mind, or perhaps a password manager only he knew. The family knew the assets existed, having witnessed his excitement over Bitcoin and Ethereum for years. Yet, accessing them felt like trying to find a needle in a digital haystack, with no map. The sheer emotional toll, coupled with the legal and technical complexities of proving ownership and gaining access, quickly became overwhelming, leaving them wondering if Mark’s digital legacy would simply vanish into the ether.

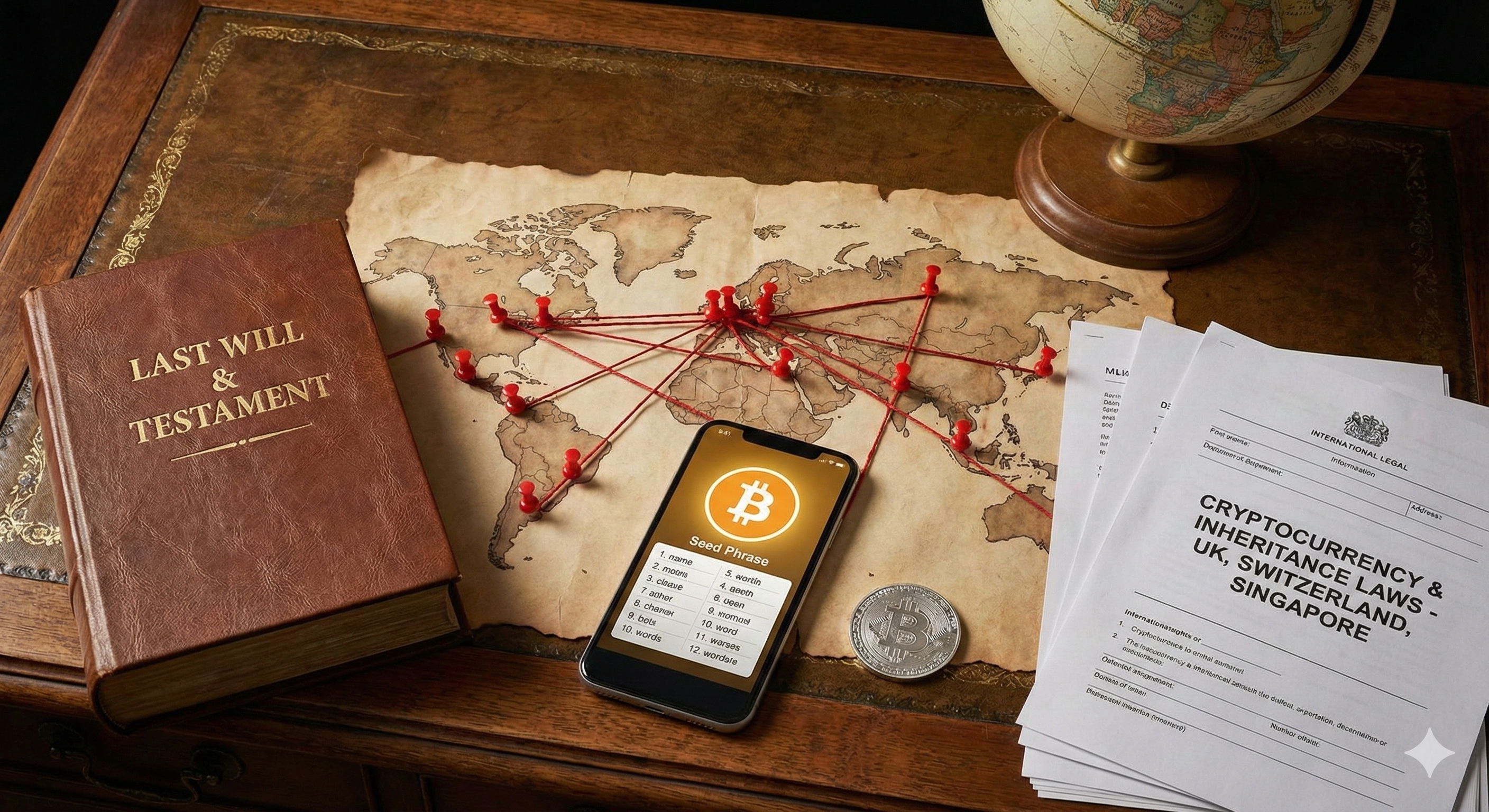

This scenario is far from unique. The decentralized, pseudonymous nature of cryptocurrency, coupled with the absence of a central authority like a bank, makes traditional estate planning woefully inadequate. When an individual passes away, their digital assets don't simply transfer to a next of kin; they remain locked, potentially forever, unless a clear, actionable plan is in place. This global legal minefield is exacerbated by differing jurisdictional laws on digital asset ownership, privacy, and inheritance, creating a complex web of challenges for grieving families and their legal representatives.

One robust strategy to mitigate this risk involves the proactive implementation of multi-signature (multi-sig) wallets. Imagine needing two or three keys to move funds: one held by the owner, one by a trusted family member or designated executor, and perhaps a third by an independent legal counsel or specialized trust service. This provides a clear, secure path for asset transfer upon a specified event, such as a death certificate being presented, while maintaining security and control during the owner's lifetime. It prevents any single point of failure and ensures that assets can be accessed without compromising security.

As the crypto landscape matures, the emergence of specialized digital asset estate planning services offers another critical layer of protection. These firms assist individuals in integrating their digital assets into comprehensive wills and trusts, often leveraging secure key storage solutions or 'dead man's switch' protocols that release access information after a predetermined period of inactivity or upon verification of death. From a legal perspective, frameworks like the Uniform Law Commission's Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) in the United States provide a template for fiduciaries to access digital assets. While RUFADAA primarily addresses assets held by custodians (like exchanges), its principles can inform how courts approach self-custodied crypto, emphasizing the need for explicit instructions from the deceased.

Ultimately, the simplest yet most overlooked strategy is meticulous, secure documentation. This isn't just a list of passwords; it's a carefully constructed, encrypted guide to your entire digital estate, outlining asset locations, wallet types, exchange accounts, seed phrases (if applicable), and designated beneficiaries. This "digital will" should be stored offline in a secure physical location or on a highly encrypted hardware device, with trusted individuals knowing how to access that device and, crucially, the decryption key.

Just last month, our team assisted a client whose deceased husband had substantial Bitcoin holdings, known only through anecdotal mentions. Through meticulous on-chain analysis, cross-referencing fragmented digital footprints from his old devices, and leveraging publicly available data, we managed to identify potential wallet addresses and transaction histories. This information, corroborated with court orders, allowed the estate to eventually recover a significant portion of the assets, demonstrating the critical role of forensic expertise when proactive planning falls short.

Navigating this complex terrain requires foresight. For anyone holding significant digital assets, proactive planning is no longer optional; it's essential. This includes not only establishing clear inheritance protocols but also regularly obtaining professional appraisals of your digital assets. Knowing the true value and provenance of your crypto holdings is the first step in securing their future for your loved ones.